Loan Officer Resume Certifications

Why let your impressive certifications gather digital dust when they can help your resume leap off the slush pile like a caffeinated squirrel? This article dives into the art of flaunting those shiny credentials—showing you exactly how to make your Loan Officer resume irresistible to lenders and recruiters alike. Read on to snag a shortcut to standing out, and learn which badges actually matter.

Why Certifications Matter for Loan Officer Careers

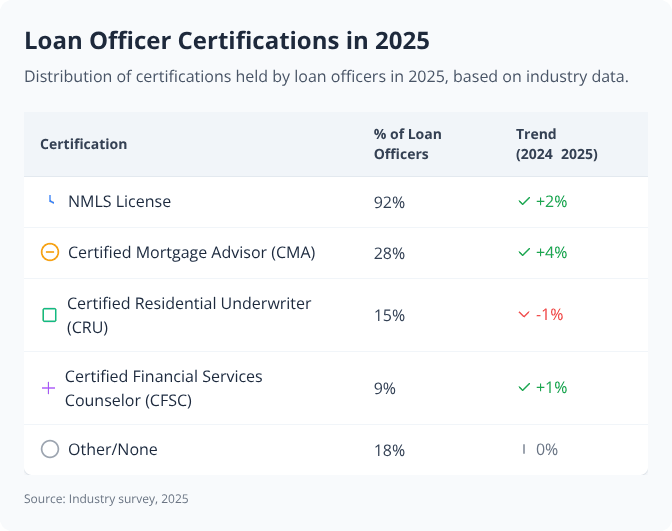

Certifications send a clear signal: this person knows their stuff. When a loan officer has official credentials, it’s not just a piece of paper—they’re showing real understanding of complex regulations and lending practices. That stamp of approval boosts trust with clients and employers alike, quieting doubts before they start. In a field crowded with hopefuls, certified professionals stand out, making hiring managers take a second look.

Adding a certifications section to your resume can really boost your chances, especially for loan officer jobs where proof of specialized skills matters.

Must-Have Certifications for Loan Officer

- Mortgage Loan Originator (MLO) License (NMLS) – Required nationwide, this license verifies federal and state-level knowledge, enabling professionals to legally originate residential mortgage loans.

- Certified Mortgage Banker (CMB) – The industry's gold standard, this credential from the Mortgage Bankers Association signals deep expertise and commitment to ethical lending practices.

- Certified Residential Mortgage Specialist (CRMS) – Awarded by the National Association of Mortgage Brokers, this distinction demonstrates advanced knowledge in residential lending.

- Accredited Mortgage Professional (AMP) – This entry-level certification from the MBA paves the way for foundational mastery of mortgage practices and laws.

- Certified Financial Services Counselor (CFSC) – Recognition that a loan officer can guide clients through complex financial decisions and empower them with sound advice.

- Chartered Financial Consultant (ChFC) – Although broader in financial planning, this qualification strengthens a loan officer’s advisory capabilities in mortgage products and credit.

- FHA Direct Endorsement (DE) Underwriter Certification – This specialized HUD credential authorizes professionals to review and approve FHA loans, raising their value in government-backed lending.

DO'S

- Highlight certifications near the top of your resume to grab attention fast.

- Use the exact names of credentials, plus awarding organizations and completion dates.

- Show certifications relevant to loan origination, mortgage, or finance specifically.

DON'TS

- Don't list expired or irrelevant certifications.

- Don't forget to specify the full certification name and issuing organization.

- Don't exaggerate or fabricate certifications you do not hold.

Pro Tip: Showcasing the right certifications up front catches a hiring manager’s eye fast, reassuring them you’re qualified without making them dig through your resume for proof.