Financial Analyst Resume Certifications

Forget burying your shining badges under a heap of spreadsheets—relevant certifications are your golden tickets in the Financial Analyst job hunt. This article spills the secrets: why picking the right credentials matters and exactly which ones send hiring managers’ eyebrows skyward. Get ready to discover how to make your resume shout, “I know my stuff!” without uttering a word.

Why Earning Certifications Is Key for Financial Analyst Success

A crisp certification on your resume flashes instant credibility—it tells employers you’ve put in the work and know your stuff beyond just the basics. When everyone’s saying they’re great with numbers, a credential draws a line: this one actually studied the hard stuff and passed. Hiring managers notice, especially when dozens of candidates look similar on paper. That extra stamp can tip the scales in a blink, unlocking doors you might not even know existed.

Adding a certifications section to your resume can really boost your chances, especially for financial analyst roles where proven skills and credentials matter.

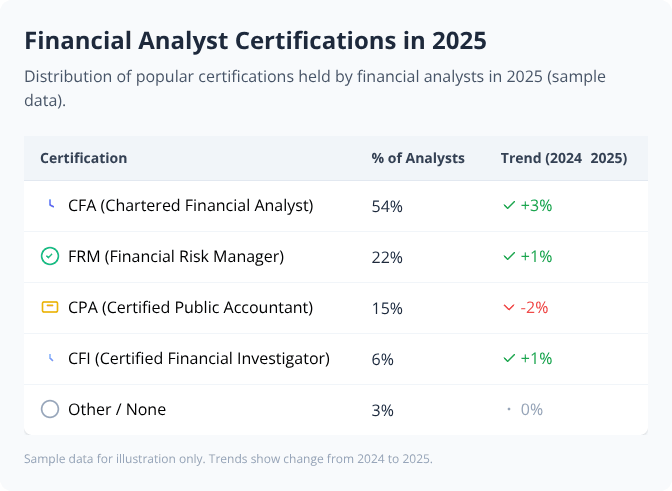

Essential Certifications for Advancing as a Financial Analyst

Chartered Financial Analyst (CFA): Global standard in investment analysis and portfolio management, signaling deep expertise and dedication.

Certified Public Accountant (CPA): Core credential in accounting and financial reporting, opening doors in corporate finance and beyond.

Financial Risk Manager (FRM): Recognized benchmark for professionals specializing in risk assessment, mitigation, and quantitative analysis.

Chartered Alternative Investment Analyst (CAIA): Niche but powerful, this covers hedge funds, private equity, and alternative investments with unmatched depth.

Certified Management Accountant (CMA): Focused on budgeting, performance management, and strategic decision-making, ideal for analysts in corporate environments.

Certificate in Quantitative Finance (CQF): Heavy on math and programming, this equips analysts for financial engineering and complex modeling.

Certified Financial Planner (CFP): Essential for those blending analysis with client-facing roles, offering credibility in wealth planning and personal finance.

DO'S

- Include the full name and abbreviation of each certification.

- List the date earned or expiration if applicable.

- Place certifications in a dedicated section near the top or under your education.

DON'TS

- Don't list outdated or irrelevant certifications.

- Don't exaggerate your level of achievement or certification dates.

- Don't clutter the section with non-financial or unfinished credentials.

Pro Tip: Crowd a resume with every badge you own and what stands out? Nothing. List only the certifications that shout “finance pro, ready to deliver”—because the rest is just static background noise to a hiring manager’s quick scan.